Open Enrollment for Medical Benefits: A Small Price for Peace of Mind

Open Enrollment begins at 12 p.m. Oct. 19

Laying in a bed in Duke Regional Hospital’s Emergency Department, the past 24 hours felt like a whirlwind to Shannon Robbins.

In that span last March, Robbins, 54, went from having abdominal pains, to seeing her primary care doctor, and finally a hospital bed facing surgery for an intestinal blockage.

“I didn’t realize how bad it was,” said Robbins, staff assistant in the Office of Finance and Administration at Trinity College of Arts & Sciences.

There was at least one thing she felt ready for. In an uncertain time, Robbins’ Duke employee health coverage was there for her, just like it is for the roughly 74,000 other employees and dependents covered by Duke plans.

After her primary care visit, tests, surgery and three days recovering in the hospital, the total cost of Robbins’ care was $44,129. With her Duke Select coverage, she only paid $770.

“When you go to the emergency room, somebody comes around, takes your information and asks how you want to pay for your visit,” Robbins said. “It was nice to pull out my WageWorks card and say, ‘Put it on this.’”

“When you go to the emergency room, somebody comes around, takes your information and asks how you want to pay for your visit,” Robbins said. “It was nice to pull out my WageWorks card and say, ‘Put it on this.’”

With Open Enrollment for medical, dental and vision coverage running from 12 p.m. October 19 through October 30, now is the time to enroll in or change medical, dental and/or vision insurance plans, and enroll in health and dependent care reimbursement accounts, which save you money.

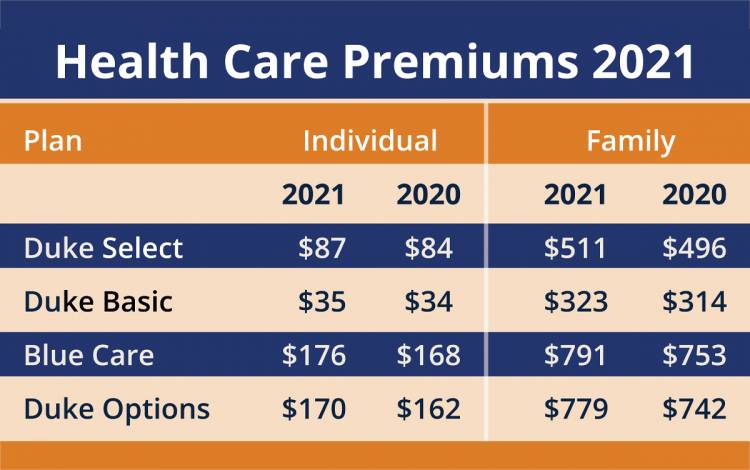

In 2021, the monthly premium increases for Duke plans will stay below projected national averages. For Duke Select, the most popular employee medical plan, the increase is $3 per month for individuals and $15 for families. Co-pays and deductibles for medical, dental and vision plans are unchanged.

With COVID-19 changing the way many people receive care, virtual office visits with regular health care providers, including behavioral health providers, are covered under Duke’s plans with the regular co-pay. And COVID-19 medical concerns can be addressed through telehealth with “Duke Health Anywhere.”

In the past fiscal year, Duke paid $261 million for plan participants’ health concerns, up $10 million from the previous year. With more than 90 percent of eligible employees enrolled, Duke’s plans are among the largest on the East Coast and as popular as ever.

Robbins started working at Duke 31 years ago, but had stints elsewhere. Each time, Duke’s health coverage, with its lower costs and easy access to care, helped draw her back.

Robbins started working at Duke 31 years ago, but had stints elsewhere. Each time, Duke’s health coverage, with its lower costs and easy access to care, helped draw her back.

“I heard other people’s stories, and I always knew we were doing well here,” Robbins said.

After last year’s scare, she has a story of her own that proves it.

“It just felt good not to worry,” Robbins said.

Got something you would like for us to cover? Send ideas, shout-outs and photographs through our story idea form or write working@duke.edu.